Global Markets waiting for Central Banking and Governments actions

1. EDITORIAL

In the last days it seems the markets are gaining a momentum of stabilization; the commodity space is stabilising, including crude oil. The attempts to take commodity values lower in February have failed. The USD has entered a period of consolidation around the 1.10 level.

Credit market stabilisation should follow that of commodities. Consolidation in credit markets is becoming apparent. The recovery of equity values is becoming more plausible with each failed attempt to push markets lower.

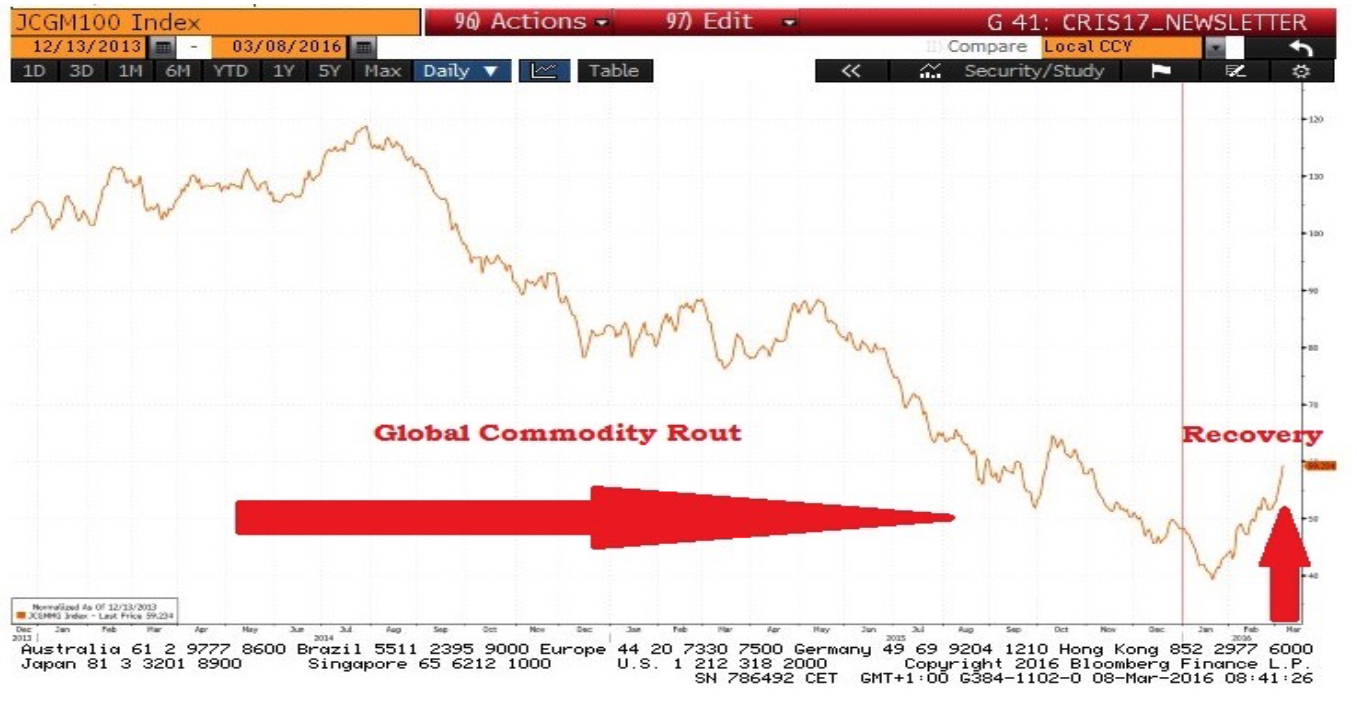

In particular, the recovery of commodity-sensitive equity, representing “global value”, is already advanced, having begun in January (see Figure 1). Consequently, the breadth of trans-Atlantic equity markets has begun to improve.

Figure 1 – Euromoney Global Mining Index [JCGMMG Index]

Financial operators remain very cautious. In particular, the momentum money that dominates the behaviour of continental European equity flows it seems to be and stay on a position of Net Selling until the macroeconomic data and political scenarios will be much clearer. The absorption of excess volatility in equity markets will take some time.

The credit-banking crisis that was the most damaging feature of this year’s beginning marked the final stage of the USD-commodity shock in a sort of relay. Most investors reduced their activity on the markets through this period of turmoil, holding or transforming positions into much more liquid assets. The recovery of equity markets will continue from this time. This resembles the recovery from the sell-off of last August-September 2015.

The valuation recovery of commodity-sensitive equity since January has been the leading indicator of the end of the out-performance of defensive equity sectors that is beginning to be apparent in both Europe and the USA. Almost everywhere we are seeing indications that commodity-sensitive assets are stabilising, including developed commodity currencies (in particular AUD & CAD) and many less developed equity markets.

The quality trade based on the out-performance of higher quality names has been the principal beneficiary of this USD-commodity shock, especially in Europe. Asset managers are gaining exposure to cyclical risk and to lower quality equity paired with a volatility management to protect the portfolio positions.

A USD-commodity shock has been a constant feature of modern investment cycles characterised by leadership of growth assets and America. The deflation fall-out from this latest episode has been the most pronounced on recent record. It has produced the first nominal USD-denominated world recession of recent times.

The end of this shock signals the beginning of a recovery of nominal USD-denominated growth world-wide. Doubtless the price component of the recovery will be stronger than the volume aspect: world growth measured in constant prices is comparatively stable. In other words, this quarter should mark the beginning of the recovery of the global profit cycle. We would also expect the growth of world output and trade, measured in volume terms, to stabilise from this quarter as the adjustment of spending in the producer sphere begins to diminish.

The only remedy for every disturbance is “stimulus” of some kind, even though the diminishing returns attached to such policies are more and more apparent. The Central Banks are desperate to maintain the illusion of their control on the prices’ dynamics and inflation expectations.

If excess money does not work there must be fiscal stimulus. The faith in market mechanisms continues to be undermined. The misallocation of resources and decline of productivity associated with over-active monetary policies have contributed to the decline in the growth of productive potential throughout the developed world.

Accordingly, investors should witness a gradual recovery of the growth of profits world-wide from this time. This is recovery of a modest cyclical nature because the structural forces of deflation remain strong.

The recovery of output and trade through this year will be modest due to structural constraints as in the last times we have been hearing some economists and financial operators to call out about “global recession”.

The USD-commodity shock has supressed both inflation and interest rates in the developed commodity-importing world. The counterpart of the deflation in global product markets is the inflation of the domestic assets that are not affected by over – investment and over-supply. In the leading developed economies prices of “domestic assets” are rising at an annual rate of about 3% or a little more.

Of course, the crucial component of domestic inflation is labour costs. The leading economies continue to approach conditions of virtual full employment. The Central Banks’ pretension to control the price regime means that they are encouraging domestic inflation in order to offset the effects of the deflation in world product markets which they cannot arrest.

Two further remarks seem to be important at this stage. In the first place, our interpretation implies that the most recent phase of decline of yields of the most secure debt in the USA and Europe should have exhausted itself in this month of February. We will probably have to wait until the ECB meeting of March 10th and its aftermath before we have evidence of reversal in the EZ’s debt markets.

The operators think that on the next 10th March the ECB should cut the discount rate by 10 or 20bps and to extend its QE programme; but, commodity stabilisation and the gradual recovery of nominal growth world-wide should prove to be more powerful than the influence of Central Banks. Clearly, there cannot be a significant recovery of the value category of stocks without a degree of steepening of yield curves.

We want to leave you with two graphs that explains the behaviour of inflation expectations, in the US (USD Inflation Swap Forward 5Y5Y) and in the Eurozone (EUR Inflation Swap Forward 5Y5Y) from the starting of the QE programs on the both side of the Atlantic (US: QE1 Dec08 – Mar10; QE2 Nov10 – Jun11; QE3 Sep12 – Dec13; EU: QE Jan15 – ongoing). So we can ask to ourselves if these policies added boost to inflation expectations or seems not too perfect.

Figure 2 – FED Balance Sheet & US Inflation Expectations

The second remark concerns the vulnerability of Europe. The last six months have demonstrated once more that US equity is the “quality trade” from the international point of view. Periods of turbulence in financial markets invariably emphasise Europe’s vulnerability, especially when the stress is focused upon the credit-banking space. As in the case of Japan, it has been demonstrated that QE programmes outside America are ineffective supports of equity values if they do not translate into currency depreciation.

The EU is threatened with political fragmentation due to the intractable crisis of migration-terrorism. The media fascination with the Brexit story is a metaphor for the widespread disillusionment with European integration.

In Britain the political class does not exhibit the self-confidence that is required to defend a coherent alternative to the EU.

Figure 3 – ECB Balance Sheet & EZ Inflation Expectations

The year has begun with a reminder of failure to restore the health of Europe’s banking system due in equal part to fragmented and incoherent re-regulation and the quasi-deflationary environment. It remains to be seen if the ECB has understood the need to reconfigure its QE programme in order to support the EZ’s banks, especially those of the periphery. There is an evident contradiction between the ECB’s efforts to improve the mechanisms of monetary transmission and the neglect of the profitability of the banks.

Cristian Rusconi

2. FOCUS on “Brexit”

The GBP jumped for a fourth day versus the EUR last week, its longest run of gains since November 2015, as investors questioned the extent of declines driven by concern over a possible British exit from the European Union.

GBP was little changed against the USD. While economic data shown by the Markit Economics said U.K. manufacturing expanded last month at the slowest pace in almost three years, that was preceded by data which showed factories in the euro area cut prices at the fastest pace in almost three years in February. That added to evidence that the 19-nation economy may need extra stimulus when European Central Bank policy makers meet on March 10th.

The GBP still declined more than 5 percent against both the USD and the EUR this year amid the prospect of the country voting to leave the EU in a referendum the next June. Other assets have fared better, with U.K. government bonds posting the biggest returns this year among developed-country markets tracked via the Bloomberg World Bond Indexes, while the FTSE 100 Index of shares climbed to a two-month high today.

Some analysts state that if one could take a step away from the “Brexit” risk and focus only on the fundamentals, the GBP looks and seems oversold so we advise to focus on this currency in the near and mid future within the portoflios.

Figure 4 – EURGBP FX [Dec. 2014 – Mar 2016]

3. DATA TO WATCH

US

- 10th March: Initial Jobless Claims & Continuing Claims

- 10th March: Bloomberg Consumer Comfort

- 10th March: Monthly Budget Statement

- 10th March: Import Price Index MoM & YoY

- 15th March: Retail Sales Advance MoM

- 15th March: PPI Final Demand

- 15th March: NAHB Housing Market Index

- 16th March: MBA Mortgage Applications

- 16th March: Housing Starts & Building Permits

- 16th March: CPI MoM & YoY

- 16th March: Industrial Production & Capacity Utilization

- 16th March: FOMC Rate decision

EU

- 10th March: ECB rates decision [EZ]

- 10th March: Manufacturing Production & Industrial Production [FRA]

- 10th March: Unemployment [ITA]

- 10th March: Trade Balance [GER]

- 11th March: Trade Balance [UK]

- 11th March: CPI MoM & YoY [GER]

- 11th March: Industrial Production MoM & YoY [ITA]

- 14th March: Industrial Production MoM & YoY [EZ]

- 16th March: Jobless Claims Change [UK]

- 17th March: CPI MoM & YoY [EZR]

- 17th March: BoE rates decision [UK]

DISCLAIMER: The only purpose of this document is to provide information about the current markets. This newsletter is prepared for information purposes only and should not be interpreted as investment advice. It does not constitute an offer or invitation by Framont to any person to buy or sell any security or instrument or to participate in any transaction or trading activity. It does not want to solicit the subscription of financial products and services, which must only be done after reading and understanding the Prospectus and any other related information. Framont & Partners Management Ltd verified very carefully the information contained in this document, but it does not ensure that such information is complete and correct and is not responsible either about the use that third parties make of such information or about any los s or damage that may arise after that use. Information included in this newsletter is considered as current as at the date of publication , without regard to the date on which you may read or be provided with such information. We do not accept any liability arising from any inaccuracy or omission in the information on this website. Every investor should always read the Prospectus and any other available information before making an investment decision. Furthermore, the yield or other terminology used to indicate the return is not guaranteed and may go down as well as up. The performance figures quoted (if any) refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. An investment product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. More details about Framont are available on the website www.framontmanagement.com.