The Power of Dividend Investing: Building Your Financial Future

In the ever-changing landscape of investing, everyday individuals are on the lookout for strategies that not only promise returns but also offer stability and long-term growth. Enter dividend investing, a timeless approach that has weathered market shifts and proved its mettle. This article delves into the world of dividend investing, illuminating its potential as a formidable tool for retail investors aspiring to construct a sustainable stream of passive income.

What is Dividend Investing?

Dividends, often overlooked treasures, represent a share of a company’s profits distributed to its shareholders rather than being reinvested. Essentially they are a bonus on top of the capital growth resulting from an increase in the company’s share price. This unique combination of steady dividends and potential capital appreciation historically positions dividend stocks to outperform the broader market, like the S&P 500, and with less market volatility.

Figure 1- Source: Kenneth French. Cumulative returns are assumed to be pre-tax.

When you receive a dividend you can choose to reinvest it in the same company, magnifying your returns, allocate it to a different investment, or simply pocket the dividend as cash for personal use.

Benefits of Dividend Investing: Personal Wealth Building

Income Boost

The primary allure of dividend investing lies in the additional income it generates. Investors holding stocks with reliable dividends enjoy periodic payouts, adding an extra layer to their investment strategy.

Compounding Returns

The magic of compounding returns – the opportunity to use received dividends to purchase more shares of the same stock, thereby increasing ownership. With each increase in ownership, your claim on future dividends grows. This compounding effect isn’t just about short-term gains; it’s a pathway to significant long-term wealth creation, a potential boon for your retirement fund over a 20-year investment horizon.

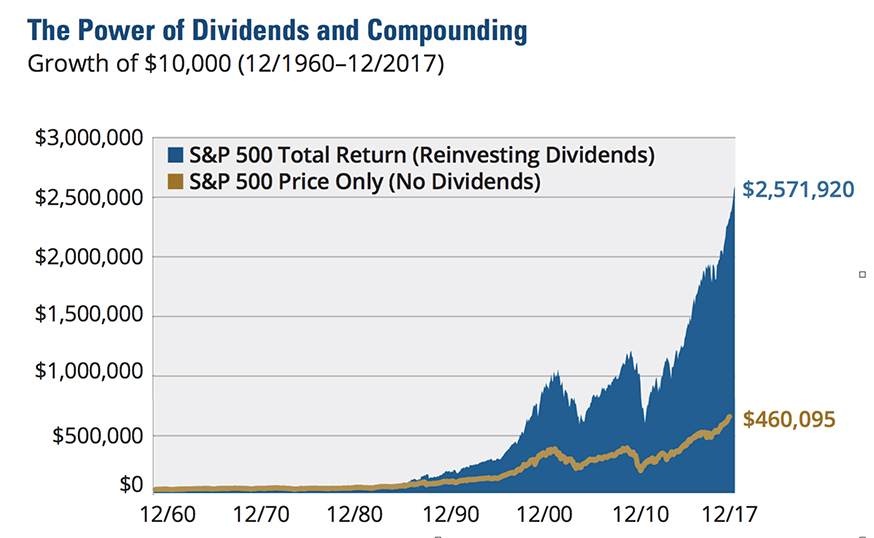

Look at the example below.

The Power of Dividends and Compounding

Consider the graphic above, showcasing the stories of “Client A” and “Client B.” Both invested $10,000 in the S&P 500 index in December 1960, withdrawing in December 2017. Client A reinvested dividends, while Client B opted to spend them as they came. The result? A staggering 459% increase in performance for Client A, who now sits on $2.6 million, compared to Client B’s $460,000 (gross). The difference is not just a number; it’s a testament to the real impact of dividend investing.

Contrary to the example I have just provided, dividend investing isn’t only tailored for the long haul. Even short-term investors, particularly those approaching retirement, can benefit from the appeal of low volatility. The prudent allocation of a higher portion of their portfolio to dividend aristocrats can help mitigate risks and reduce the chance of sharp declines in funds over the short term.

Identifying Strong Dividend Stocks

Companies with a track record of consistently increasing dividends are your dividend aristocrats. These businesses often operate in stable, mature industries, offering you a reliable income source. As a retail investor, your journey involves identifying stocks that have consistently paid dividends over time and, ideally, have increased these payouts. However, remember that diving deeper into a company’s financial health and future growth prospects adds layers to your analysis, making sure you see the bigger picture before making investment decisions. If navigating this feels daunting, and you are not used to making your own investment decisions, talk to a professional for guidance.

Do take care when looking at stocks with high dividend yields, as with anything in life, if it looks too good to be true, it probably is. High dividend yields can be a direct results of a low share price, suggesting poor future growth prospects. Alternatively it maybe because the company is restricted in its growth, and therefor pays a larger sum of its earnings as dividends, rather than reinvesting into the business. There are a multitude of factors that may impact the dividend yield of a particular stock, so take care and understand the reasoning behind a company’s dividend yield.

Building Your Dividend Portfolio: Navigating Equities

Reading this article so far it might be possible to forget the fact that we are still discussing equities here. Naturally, they are still a “growth” asset, meaning the risk would be considered higher than what can be found in other more defensive asset classes.

As with any portfolio, diversification is critical and that principle still applies here. As I have discussed in previous articles which can be found on the Framont & Partners Management News page, collective investment vehicles are an effective way for retail investors to gain the benefit of immediate diversification.

In today’s age, you can find an collective investment vehicle for pretty much anything. So ETFs with a focus on high dividends are an effective option for retail investors looking to diversify their holding with a focus on companies with strong dividends.

Tax Implications and Considerations: A Personal Fiscal Perspective

Understanding the tax implications of your investment journey is vital. Taxes depend on your fiscal residence, and dividends are usually considered taxable income. As you receive dividends, reporting these earnings on your income tax returns might become necessary. Some tax systems categorise dividends as either qualified or non-qualified, with different tax rates applied. Qualified dividends often enjoy lower tax rates, providing you with a potential advantage.

Investors should also note that when participating in Dividend Reinvestment Plans (DRIPs), be mindful of the tax consequences. Even though you’re receiving additional shares, those reinvested dividends still count as taxable income.

Why dividend investment can lead you to financial success

In conclusion, dividend investing unveils itself as a time-tested strategy for retail investors, offering not just returns but a pathway to building wealth and generating passive income. By understanding the benefits, identifying strong dividend stocks, and adopting a disciplined approach to managing your portfolio, you position yourself for financial success.

To delve deeper into how dividend investing can seamlessly fit into your investment portfolio, book a free initial consultation through the email provided below.

This marketing document has been issued by Framont & Partners Management Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country, or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation, or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions, and comments of Framont & Partners Management Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Framont & Partners Management Ltd entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Framont & Partners Management Ltd. does not guarantee its completeness, accuracy, reliability, and actuality. Past performance gives no indication of nor guarantees current or future results. Framont & Partners Management Ltd. accepts no liability for any loss arising from the use of this document.